Headlines are full of large-scale fuel thefts committed by organized crime. Sophisticated criminal groups tap pipelines, drill or siphon fuel from vehicles, or collect payment data using camouflaged skimmers. That data is then used to purchase as much fuel as possible, often in vehicles modified to hide “bladder tanks” that can hold hundreds of gallons. The stolen fuel is then resold on the black market. Headline of news article about a fuel theftWhile conservative estimates put the global impact of fuel theft at around $133 billion per year, there are no definitive statistics available for the US. Yet we know that the numbers are staggering. For example, in March 2022, thieves used a remote to directly access underground pumps at a gas station in Aurora, Colorado, stealing about $50,000 worth of fuel in a single incident. Fuel theft occurs in every state across the US and impacts the entire fuel chain, from manufacturer to distributor, to fuel station owner, to the individual filling up their tank.

"Fuel theft occurs in every state across the US and impacts the entire fuel chain, from manufacturer to distributor, to fuel station owner, to the individual filling up their tank."

Large-scale organized fuel theft like that in Aurora is devastating for the victims. However, there is another, less publicized type of fuel theft and, at least from the experiences of our customers, it’s a more common occurrence for general businesses. That is theft by employees. Incidents of internal theft is when an employee fills up their personal vehicle using a company gas card. They might also put personal charges, such as cigarettes or concessions on the card. This type of fuel theft is called “slippage”.

Small transactions add over time. In March, Connecticut USPS driver Lindim Asipi plead guilty to stealing postal funds. Over an 18 month period between January 2020 and June 2021, he inappropriately used his fleet fuel card hundreds of times, totalling $40,000 to $95,000. The USPS overlooked a powerful tool that could have limited, if not stopped Lindim Asipi entirely: cardlock settings.

Your cardlock settings can prevent and reduce the impacts of both employee fuel slippage and organized fuel theft. As a Carson cardlock customer, we will help you review and adjust settings to protect your business.

Cardlock settings are your fail-safe should you become the target of fuel theft – whether it’s committed by a disgruntled employee or organized criminals. Businesses with poor cardlock account settings can be paying 15% more in overall fuel costs, as reported by the National Association of Fleet Administrators.

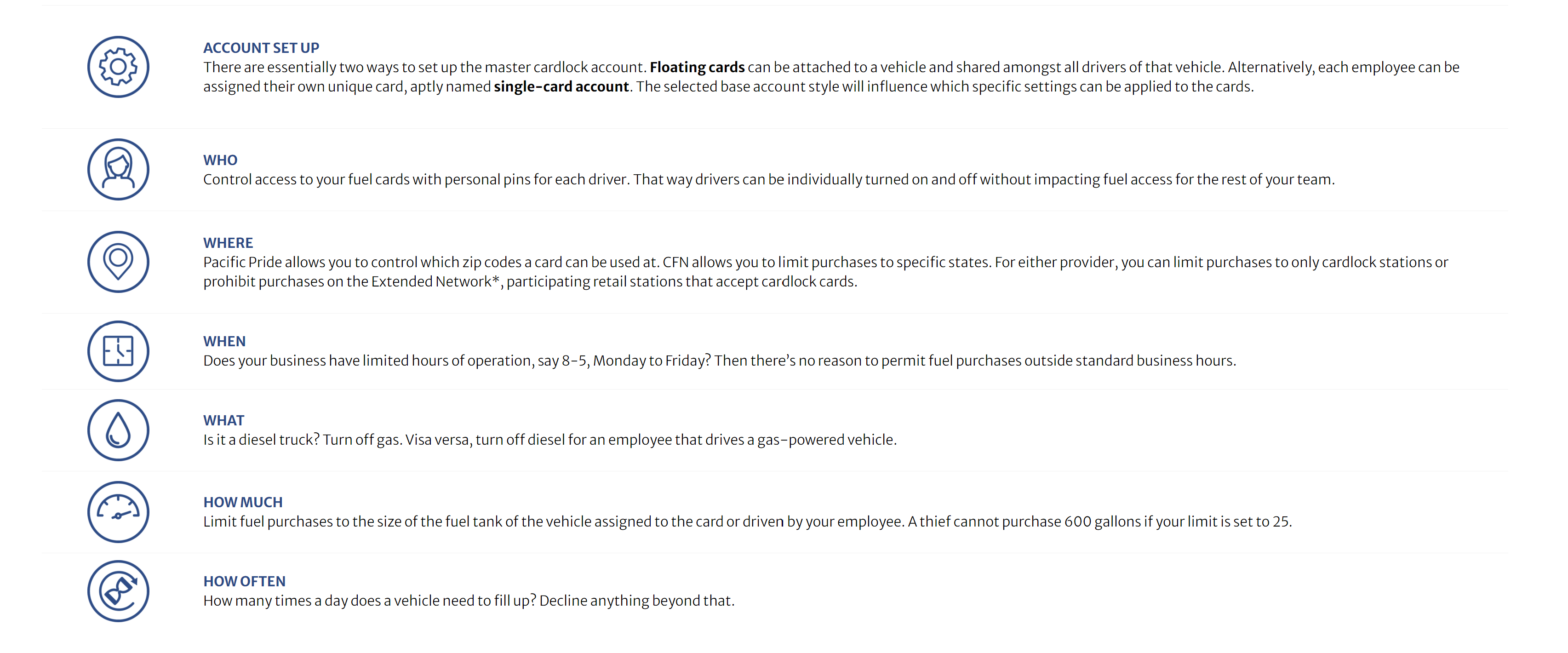

Nearly every aspect of a fuel purchase has some sort of control setting on your CFN or Pacific Pride account. You establish the settings for your cards and users. For busy managers, it’s easiest to keep all options open for that ‘just in case’ scenario. However, this is exactly what makes your business an easy target for fuel thieves and unscrupulous employees. A carefully protected account requires a thorough understanding of your business’ fuel use, your fleet and your staff.

In the case that a card is stolen or misused, account settings will reduce the damage caused to your business. They are also a requirement of Fleetwide’s built-in Fraud Protection Program, which is offered by both CFN and Pacific Pride networks.

Are your cardlock settings optimized to protect your business? Let’s review them together! Reach out to your assigned Carson representative or call our Cardlock Department at 800.998.7767, ext. 1013.

* Opening cards to the Extended Network not only gives your team access to participating retail stations, it allows them to purchase lubricants, DEF and similar products sold at these stations. At this time, however, neither Pacific Pride nor CFN systems have the ability to control what types of products can be purchased from participating retail stations. We encourage you to request e-receipts be turned on and carefully review all purchases if allowing Extended Network purchases.

"*" indicates required fields